Table Of Content

A conventional loan is a type of mortgage that is not insured or guaranteed by the government. We'll help you estimate how much you can afford to spend on a home. If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence. A VA loan is a mortgage loan granted to veterans, service members on active duty, members of the national guard, reservists, or surviving spouses, and is guaranteed by the U.S. This ratio is known as the debt-to-income ratio and is used for all the calculations of this calculator. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate.

How do current mortgage rates impact affordability?

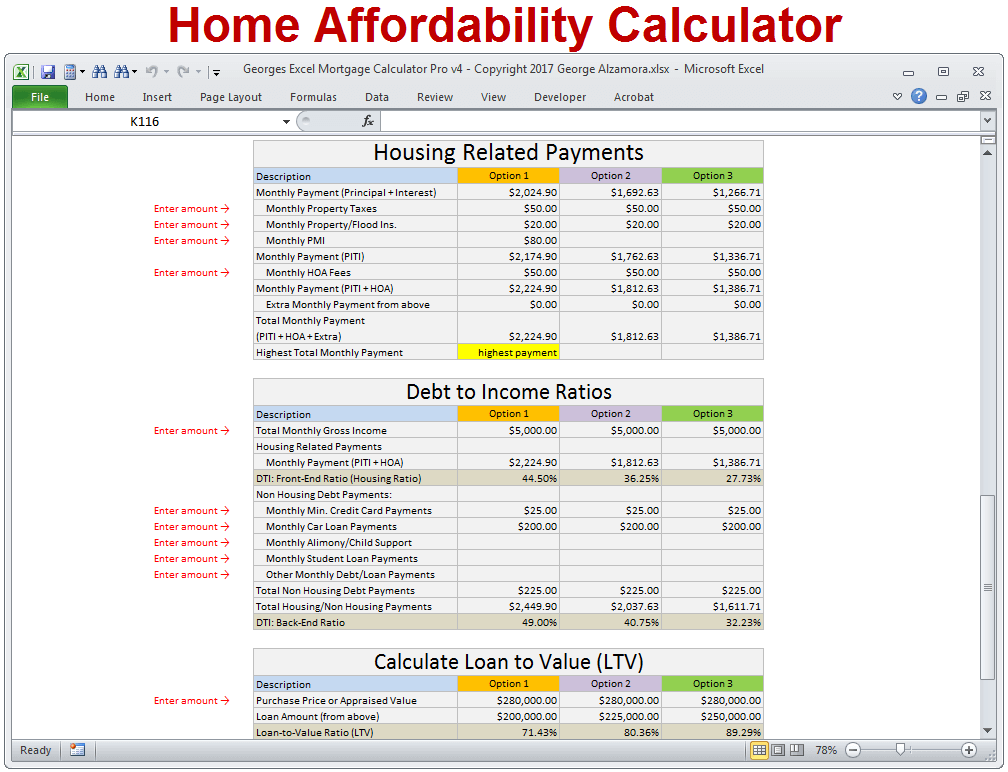

Your total monthly payment is your monthly obligation on your home. This includes your mortgage payment, property taxes, and home insurance — plus homeowners association dues (HOA) — where applicable. The question isn't how much you could borrow but how much you should borrow.

How Much House Can You Afford? Peek Inside the Numbers - Realtor.com News

How Much House Can You Afford? Peek Inside the Numbers.

Posted: Wed, 19 Apr 2017 23:03:20 GMT [source]

Custom Debt-to-Income Ratios

To find out if a house might be affordable for you, estimate your total housing expenses. Housing expenses include the principal and interest you pay on your mortgage. They also include mortgage insurance, property taxes, homeowner’s insurance and homeowner’s association fees, if you pay them. Your total mortgage costs include repaying the home loan with principal and interest, plus paying for monthly fees like property taxes and home insurance.

Calculate your buying power

A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the Conventional Loan option, which uses the 28/36 Rule. Before you start looking at real estate and shopping around for the right lender, it’s important to take these steps to improve your chances of becoming a homeowner without breaking the bank. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.

Use our home value estimator to estimate the current value of your home. Rule of thumb says that your monthly home loan payment shouldn’t total more than 28% of your gross monthly income. Gross monthly income is your monthly income before paying taxes, making contributions to retirement accounts or taking out other deductions. Lenders divide your total monthly debt payments by your income to determine whether or not you can afford another loan. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

Learn About Mortgages

When a person has a low debt-to-income ratio, it means that their debt payments make up a small portion of their gross monthly income. If you’re getting a conventional loan with less than 20% down and will have to pay private mortgage insurance (PMI), try to minimize this expense. The larger your down payment and the better your credit score, the lower your PMI rate and the fewer years you’ll have to pay it for. What if you have a student loan in deferment or forbearance and you’re not making payments right now? Many homebuyers are surprised to learn that lenders factor your future student loan payment into your monthly debt payments.

When you use the Rocket Mortgage® calculator, it’ll factor in frequently overlooked costs like property taxes and homeowners insurance. The table above shows a comparison of 30-year vs. 15-year fixed-rate loans for a $250,000 home with a 20% down payment. The monthly payments for the $200,000 mortgage includes homeowners insurance and property taxes for Kansas City, Missouri.

When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if you’re expecting a baby and want to save additional funds. To calculate how much house you can afford, we’ve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan. Homeowners insurance and property tax rates have been provided by Redfin, and are calculated at 0.22% and 1.25% a year respectively. For those looking for property in the rural areas of the state, you can see if the property qualifies for USDA eligible loans.

Living Expenses

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results.

Lenders don’t have a complete picture of your financial situation, despite all the paperwork they ask for. Both the upfront fee and the annual fee will detract from how much home you can afford. Check today’s rates to see what you might qualify for and how much house you can truly afford.

The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. But it isn’t only in your lender’s interest to keep this rule in mind when looking for a house - it’s in your's too. Since lenders tend to charge higher interest rates to borrowers who break the 36% rule, you’ll probably end up spending more on interest if you go for a house that places you beyond that limit. Plus, you may have trouble maintaining your other financial obligations, including building up your emergency fund and saving for retirement. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Please visit our FHA Loan Calculator to get more in-depth information regarding FHA loans, or to calculate estimated monthly payments on FHA loans.

Once you can put down 20%, you won’t have to pay for mortgage insurance. Using a mortgage calculator is a good way to get an idea of how much house you can afford. But only a lender can verify your mortgage eligibility and your home buying budget. Federal law requires mortgage lenders to show you a three-page Loan Estimate after you apply for a mortgage loan.

Let's take a look at a few hypothetical homebuyers and houses to see who can afford what. A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try SmartAsset's free online matching tool. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

No comments:

Post a Comment